What Is Fraud Risk Mitigation?

Without a concerted ecosystem commitment to fraud risk mitigation, the persistence of fraud may threaten to overshadow the benefits of IIPSs to low-income and women end users.

Fraud risk mitigation is the application of controls by payment ecosystem stakeholders to protect the integrity of the ecosystem from reputational and financial harm. “Fraud risk mitigation” and “fraud risk management” are often used interchangeably.

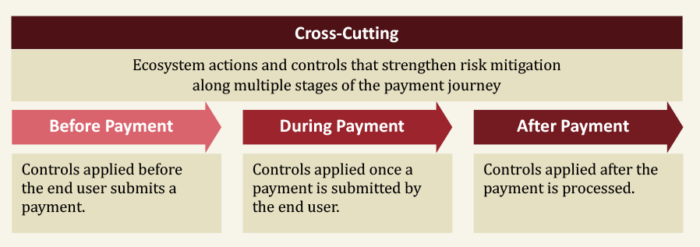

Certain controls are cross-cutting, while others are applied (and most beneficial) at specific stages of a payment. Strong fraud risk mitigation requires the application of all categories of controls.

Value of Friction

The implementation of fraud mitigating controls may introduce some frictions to the payment journey experienced by end users. The benefit of a safer instant payment system that end users can trust more than offsets these frictions.

Fraud poses a tangible risk to the financial livelihoods of low-income DFS users, as we see end users missing, delaying, or cutting back on key household expenditures following a fraud event. Effective fraud mitigation is necessary and achievable to ensure the continued growth and usability of inclusive, interoperable payments systems.

Next Topic in this Section: Strength in Collaboration